Pollinate Trading – Equities Earnings Strategy | 1,35 GB

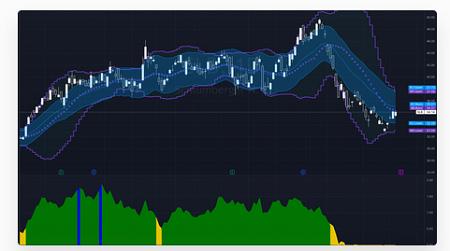

Equities Earning Strategy

Don’t get caught making the same usual gamble trades during earnings season ever again.

Be in the right stocks that have a HUGE opportunity for winners when they release their earnings, and often times you get the price rip even before they announce.

The Equity Earnings Strategy keeps you out of the high risk, low reward earnings trades that everyone on TV and Twitter are gambling on, and gets you in to the ones that make real money.

Occasionally we have an earning season that fizzles, and occasionally we have a home run season.

What you’ll get:

– Full Rules Based System

– 10+ Videos explaining the strategy and edge cases

– Quantitative Spreadsheet to filter the universe of stocks down to the most attractive

Equities earnings strategy, also known as earnings-based investing or earnings momentum strategy, is an investment approach that focuses on trading or investing in stocks based on their earnings performance. This strategy aims to capitalize on the market reaction to earnings announcements and expectations.

Here are some key aspects of an equities earnings strategy:

- Earnings Reports: Traders or investors using this strategy closely monitor earnings reports released by companies. They pay attention to key metrics such as revenue, earnings per share (EPS), and guidance provided by the company.

- Positive Earnings Surprise: The strategy often looks for stocks that have a positive earnings surprise, where a company’s actual earnings exceed market expectations. Positive surprises can lead to upward price movements as investors react positively to the company’s performance.

- Earnings Momentum: This strategy also considers the trend or momentum of a company’s earnings growth. Stocks with consistent or improving earnings growth over time may be favored.