Private Wealth Academy – Elite Tax Secrets

Welcome to the Private Wealth Academy “Elite Tax Secrets,” a revolutionary course that will challenge your perceptions of taxation and empower you with the knowledge to navigate the tax landscape like never before.

Category: Personal Finance and Taxation

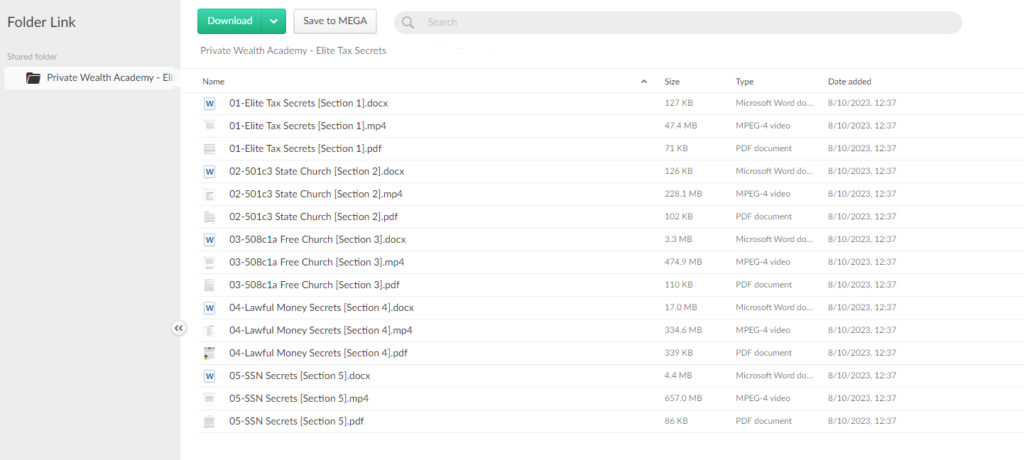

Duration: 1.72GB

Description:

Discover the Exclusive Tax Strategies Employed by the Financial Elite to Legally Reduce Their Tax Burden

Taxes may feel like an inevitable part of life, but here’s a revelation: they are not as mandatory as you might think. In a surprising twist, even Steve Miller, the former Director of the IRS, publicly acknowledged during a Congressional hearing that the tax system isn’t compulsory but operates on a voluntary basis.

Unearth the Astonishing Truth Hidden in Plain Sight

Prepare to have your perception of taxation upended. The simplicity of this method might leave you in disbelief, as the truth has been hiding “in plain sight.” It’s not a grand conspiracy; rather, it’s concealed within the labyrinthine maze of over 50,000 pages of tax code and court rulings. The Internal Revenue Service has even compiled a list of over 50 Frivolous Arguments simply because they’re tired of explaining their code. However, there exists ONE legal avenue, substantiated by Supreme Court rulings dating back to the early 1800s.

Even if you hold a conventional job with SSI and Withholding Taxes deducted, rest assured there’s a solution for you. There are only FOUR instances when having a Social Security Number is mandatory: 1) obtaining a driver’s license, 2) registering a vehicle, 3) for tax-related matters, and 4) seeking public assistance. Learn the path to permanent exemption!

But, how can you achieve this? The secrets lie within Elite Tax Secrets, where we will reveal the steps to claim your “REDEMPTION” from the taxable event commonly referred to as “income tax.” Moreover, you’ll not only gain a profound understanding but also the ability to share this knowledge effortlessly with others – it’s genuinely that simple to grasp!

Learning Objectives:

– Master the fundamentals of tax law and its voluntary nature.

– Understand the legal strategies to minimize your tax liability.

– Gain the knowledge to opt out of Social Security Number requirements.

Whom this Course is for:

– Individuals seeking to gain control over their tax obligations.

– Taxpayers looking to legally reduce their tax burden.

– Anyone interested in understanding the truth about taxes and Social Security Numbers.

Course Features:

– In-depth Tax Secrets

– Expert guidance on tax strategies

– Supreme Court-backed methods

Course Price:

Original Price: $497

Our Exclusive Price: Only $35

Join the Private Wealth Academy now to unlock the elite tax secrets and regain control of your financial future!

PROOF –

Available for instant delivery! We are always live on the chat. Hit the chatbot now.

Regular Price – 497$

Sale Price – 35$

![]() Contact us: [email protected]

Contact us: [email protected]