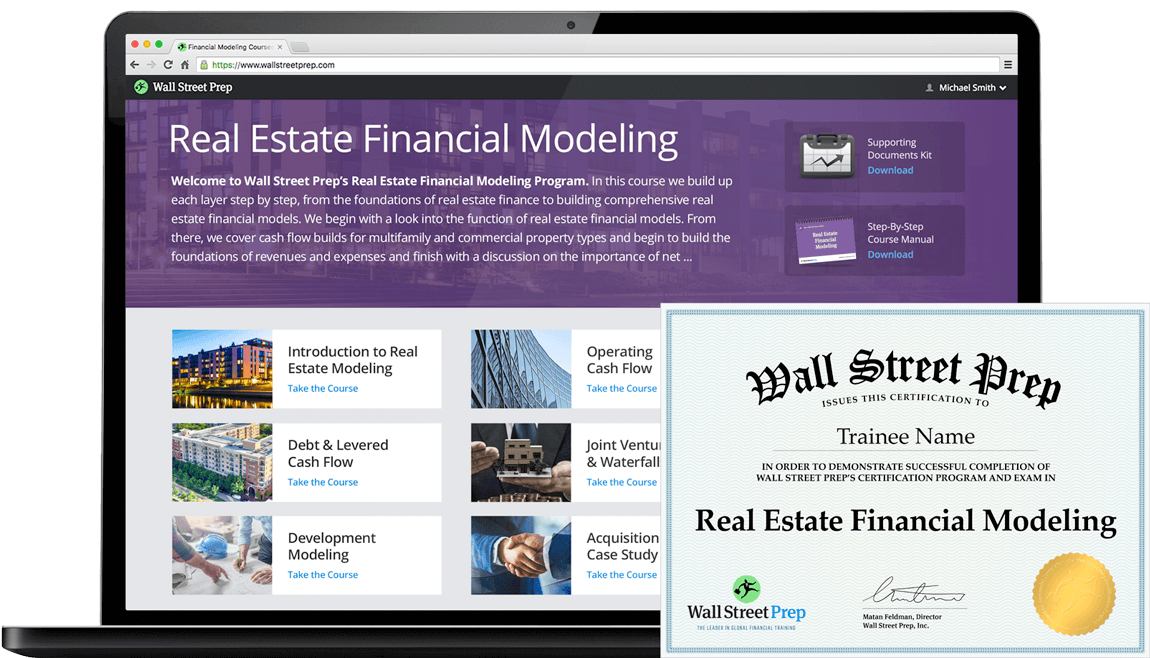

Download Now Wall Street Prep – Real Estate (REIT) Modeling. Download This Course For Cheap Price…

Wall Street Prep Description of Real Estate (REIT) Modeling

This REIT modeling course is ideal for investment banking, equity research, and real estate professionals with a focus on REITs. Trainees build financial and valuation models for a REIT the way it’s done on the job.

First, we will learn about the REIT industry’s unique drivers and challenges. We will then build REIT financial and valuation models from scratch, using a step-by-step approach for an actual company, BRE Properties. Along the way, we will cover real estate modeling best practices for same store properties, acquisitions, developments, and dispositions. In addition, we model and deconstruct critical REIT profit metrics like FFO, AFFO, and CAD. Part 2 dives into valuation modeling, with a focus on the Net Asset Value (NAV) approach.

What You’ll Learn In Real Estate (REIT) Modeling

In-depth REIT industry profile, drivers, terminology, tax advantages and structure (UPREIT’s and DOWNREIT’s)

Segment-level modeling (same store properties, acquisitions, developments, and dispositions)

REIT sector-specific drivers and forecasting best practices

Common REIT valuation approaches including Net Asset Value (NAV), comparable company and transaction analyses, and discounted cash flow (DCF) analysis

Modeling REIT-specific metrics and ratios – funds from operations (FFO) and adjusted funds from operations (AFFO / CAD)

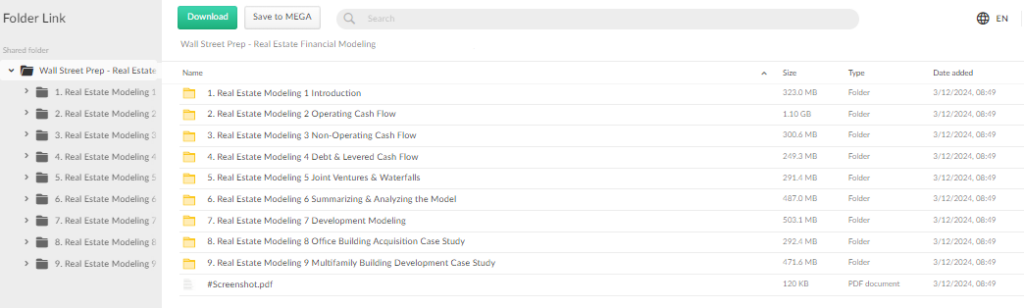

PROOF –

GET THIS COURSE FOR JUST $125

Sales Page Link

Official Price: $997

Our Price: $125

Email us if you want to buy it or contact us on chat!